- AUD/JPY could continue its winning streak due to improved risk appetite.

- The Australian Dollar depreciated due to the less hawkish RBA despite higher inflation in March.

- The Japanese Yen struggles despite the potential for intervention by Japanese authorities.

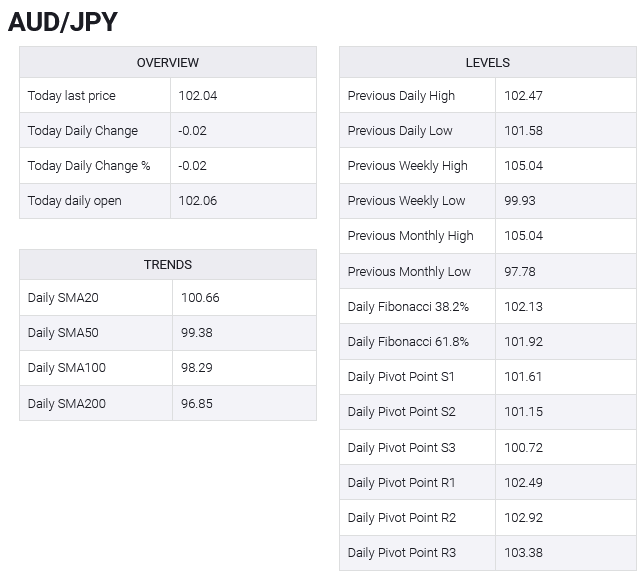

AUD/JPY Hovers Around 102.00 Amid RBA and BoJ Policy Updates

The AUD/JPY pair is hovering around the 102.00 level during the European session on Wednesday. The Australian Dollar (AUD) weakened after the Reserve Bank of Australia (RBA) maintained its interest rate at 4.35% on Tuesday, putting additional pressure on the pair. Investor sentiment had leaned towards a more hawkish stance from the RBA, especially after March’s unexpected spike in Australian monthly inflation, which contrasted with market expectations of stagnation.

RBA Governor Michele Bullock emphasized the need to remain vigilant regarding inflation risks. She expressed confidence that current interest rates are appropriately positioned to guide inflation back into the target range of 2-3% in the latter half of 2025 and to the midpoint by 2026. However, the RBA acknowledged a recent stall in progress towards reducing inflation and maintained its forward guidance of “not ruling anything in or out.”

Meanwhile, the Japanese Yen (JPY) appreciated last week amid speculation of potential intervention by Japanese authorities. According to Reuters, data from the Bank of Japan (BoJ) indicated that Japanese authorities may have allocated approximately ¥6.0 trillion on April 29 and ¥3.66 trillion on May 1 to strengthen the JPY. However, these interventions provided only temporary relief due to significant interest rate differentials between Japan and the United States.

The Japanese Yen continues to face challenges despite repeated warnings from Japanese authorities about extreme currency fluctuations. Finance Minister Shunichi Suzuki reiterated that authorities are prepared to address excessive foreign exchange volatility. BoJ Governor Kazuo Ueda also emphasized the need to assess the impact of Yen movements on inflation to inform policy decisions.