E-Trade

us.etrade.com

- Leverage: Margin Trading

- Regulation: SEC, FINRA, CFTC, SIPC, NFA, FDIC

- Min. Deposit: $0

- HQ: USA

- Platforms: Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web

- Found in: 1982

E-Trade Licenses:

- MORGAN Stanley, authorized by SEC and FINRA (USA), CRD#: 149777/SEC#: 801-70103, 8-68191

- Morgan Stanley Smith Barney LLC, a member of SIPC (USA),

- E*TRADE SECURITIES LLC, authorized by SEC & FINRA (USA), CRD#: 29106/SEC#: 8-44112

- E*TRADE Futures LLC is authorized by CFTC (USA) NFA ID 0401545

- E*TRADE Futures LLC, a member of NFA (USA),

- Morgan Stanley Private Bank, National Association, member of FDIC (USA)

E-Trade is a stock-dealing business that is owned by Morgan Stanley. It lets private buyers and traders buy and sell stocks, options, mutual funds, ETFs, futures, bonds, and CDs, among other financial goods.

According to the study we did, the company follows the strict rules set by the US SEC, FINRA, and CFTC. It is also a part of the Federal Deposit Insurance Corporation (FDIC), the Securities Investor Protection Corporation (SIPC), and the National Futures Association (NFA).

Overall, the exchange has good trading conditions and an easy-to-use interface that lets clients handle their investment accounts, do market research, and make trades.

Does E-Trade sell stocks?

Yes, E-Trade is a company that helps people trade stocks. In 2020, the company became a part of the global financial firm Morgan Stanley. Its online trading services were added to Morgan Stanley’s other financial services.

Pros and cons of e-trade

Following what we learned, the trader has both good and bad points. On the plus side, it has an easy-to-use layout, fair trade conditions, and a wide range of financial goods for buyers. The platform’s connection to Morgan Stanley makes it more stable financially and gives users access to a wider range of services. In addition, E-Trade provides a lot of study and learning materials to help buyers make smart choices.

As for the cons, the fees and charges may be higher than average, and even though the website is easy to use, people who are new to trading and dealing may still find it a bit hard to get the hang of it.

| Advantages | Disadvantages |

|---|---|

| SEC, FINRA, and CFTC regulation and oversee | No 24/7 customer support |

| $0 minimum deposit | Not suitable for beginners |

| Good education and research | |

| US traders and investors | |

| Competitive trading conditions | |

| Paper trading | |

| Advanced trading platforms | |

| Secure investing environment |

Does E-Trade work or is it a scam?

E-Trade is not a scam. The SEC, FINRA, and CFTC have set strict rules and guidelines that this stock-dealing firm must follow. These top-tier rules protect clients’ money and make investing low-risk.

Can I trust e-trade?

Yes, E-Trade is a real company that is controlled by the government. It has been approved by trustworthy US financial authorities and has a good name in the financial world.

The company also doesn’t provide services in foreign areas, which shows that it is committed to working in controlled areas and being honest with clients.

| E-Trade Strong Points | E-Trade Weak Points |

|---|---|

| Top-tier licenses | None |

| Member of NFA, SIPC, and FDIC | |

| Professional investing environment | |

| Multi-factor authentication |

Safe Trading for Clients

E-Trade cares a lot about keeping its customers’ investments safe by following government rules and best practices in the business. This promise includes putting in place strict identity verification processes and steps to stop scams and illegal account access.

As a member of SIPC, the company also covers customer accounts up to $500,000. This includes $250,000 for cash only, which adds another layer of security. Traders should still be careful, keep an eye on their finances on a daily basis, and use safe internet habits to make their trading even safer.

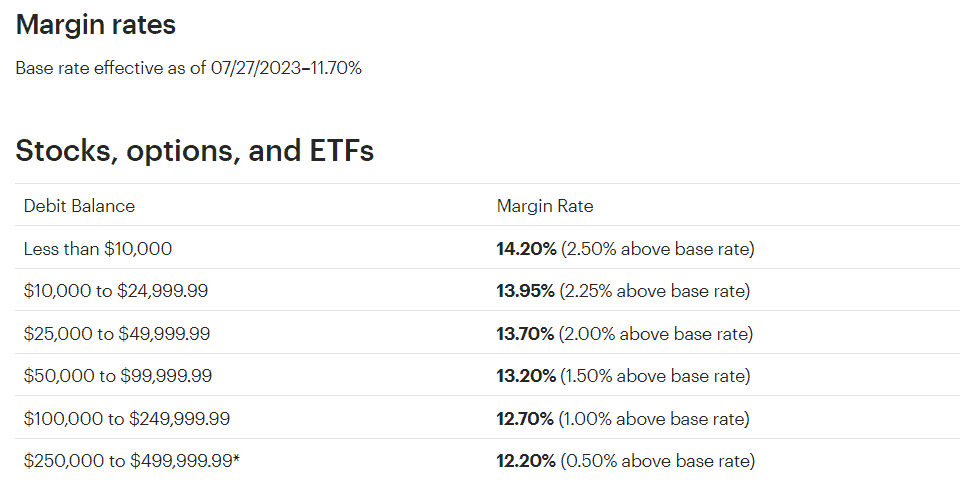

Trading on Margin

E-Trade offers margin trading, which lets buyers borrow money against their current stocks to possibly make their trading amounts bigger. Margin trading can increase profits, but it also increases risk. Before doing margin trading on the broker’s platform, buyers should carefully consider how much risk they are willing to take and the state of the market.

According to rules set by the SEC, FINRA, and CFTC, E-Trade offers margin levels:

For big exchange pairs, US buyers can use no more than 1:50.

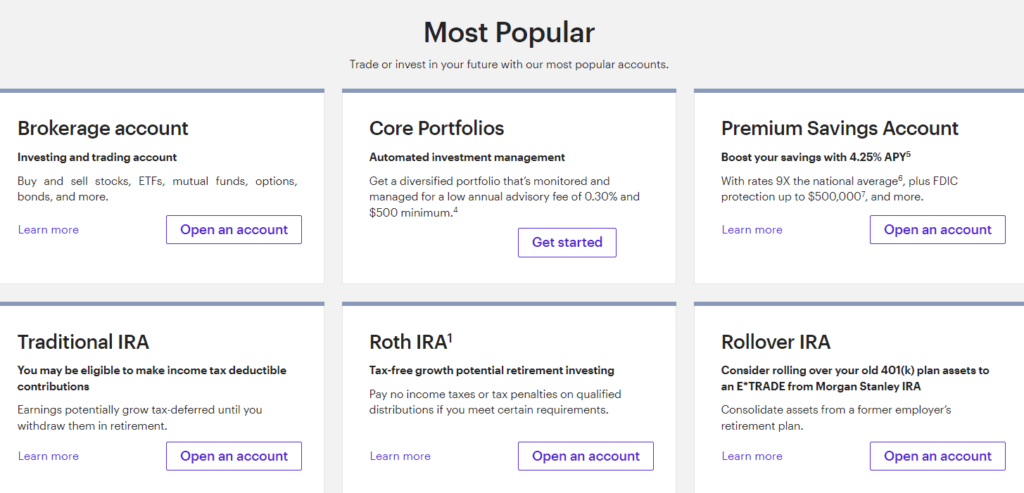

Account for E-Trade

Based on what we learned, the broker has different types of accounts to meet the needs of different investors. These include individual brokerage accounts, retirement accounts like IRAs, and education savings accounts like 529 plans. This range lets users pick accounts that offer E-Trade perks and fit their financial goals and tastes. This gives them options for how to manage their investments on the site.

| Pros | Cons |

|---|---|

| Fast and easy account opening | None |

| Variety of account types | |

| No minimum deposit |

How do I sign up for an E-Trade Live account?

People think it’s pretty easy to open an account with a broker because you can log in and register in just a few minutes. Just go to the page for starting an account or logging in to E-Trade and follow the steps given:

- Pick out the “Open an Account” page and click on it.

- Type in your personal information (name, email address, phone number, etc.), and then enter the E-Trade coupon code.

- Upload proof of residency, ID, or other information to make sure your data is correct.

- Finish the online test to prove you know how to trade.

- After your account is verified and active, you can send money.

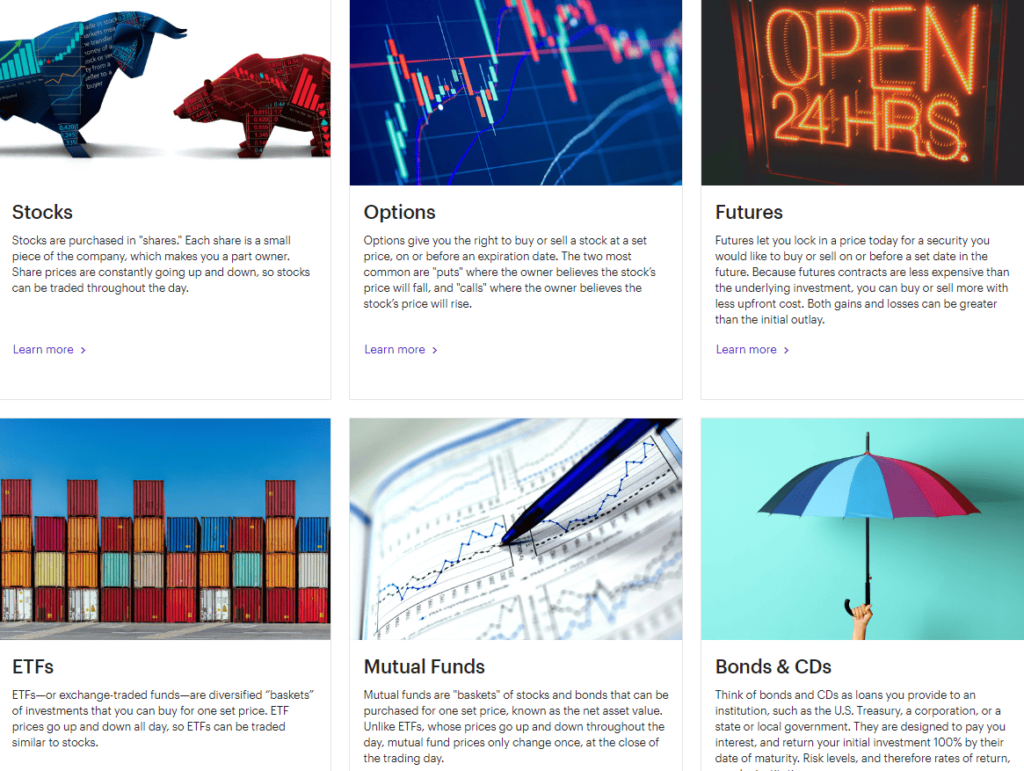

Trading Products

There are many types of trade goods that the company provides, such as stocks, options, mutual funds, ETFs, bonds, futures, and certificates of deposit (CDs). Because there are so many options, buyers can put together well-balanced portfolios and trade using a variety of methods, depending on their risk tolerance and financial goals.

We give E-Trade Markets an overall range score of 8.7 out of 10 for trading goods. They also get high marks for giving customers some unique business and trading possibilities.

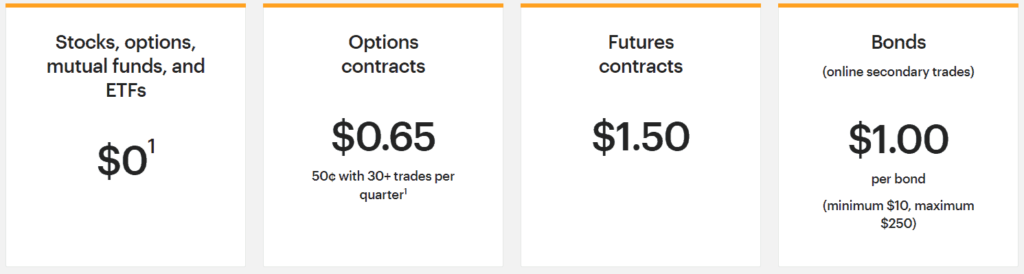

Fees for E-Trade

Based on what we found, the company charges for its selling services based on commissions. Even though the platform has reasonable prices, buyers should be aware of possible fees, such as transaction fees and margin interest rates, which can change based on the type of account and trade activity.

We tested e-trade fees and gave them an overall score of 7.9 out of 10 based on how they relate to fees charged by over 500 other companies. There are services that are free and services that may be charged. Read on for more comparison information:

| Fees | E-Trade Fees | TradeStation Fees | Merrill Edge Fees |

|---|---|---|---|

| Deposit fee | Yes | Yes | Yes |

| Withdrawal fee | Yes | Yes | Yes |

| Inactivity fee | No | Yes | No |

| Investment Plans | Yes | Yes | Yes |

| Fee ranking | Average | Average | Average |

Commission for Trading

From our test trade, we can see that E-Trade charges fees for a number of trading services, such as futures contracts, options contracts, and bond trades.

Traders should look over the broker’s full fee plan to get a good idea of how much it will cost to trade the way they want to.

Based on our tests and comparisons with other firms, the E-Trade Commission gets a good score of 8 out of 10. We found that the fees are reasonable, clear, and good for investing.

| Asset/ Pair | E-Trade Commission | TradeStation Commission | Merrill Edge Commission |

|---|---|---|---|

| Stocks Fees | From $0 | From $0 | From $0 |

| Fractional Shares | No | No | No |

| Options Fees | From $0,65 | From $0,60 | From $0,65 |

| ETFs Fees | From $0 | From $0 | From $0 |

| Free Stocks | Yes | Yes | Yes |

Trading Hours for E-Trade

We found that the company usually follows the normal trading hours of the major U.S. stock platforms. This means that users can make deals Monday through Friday from 9:30 a.m. to 4:00 p.m. Eastern Time.

The platform may also have longer trading hours, letting buyers trade before and after the market closes. This gives traders more options for responding to changes in the market before or after market hours.

Making deposits and withdrawals

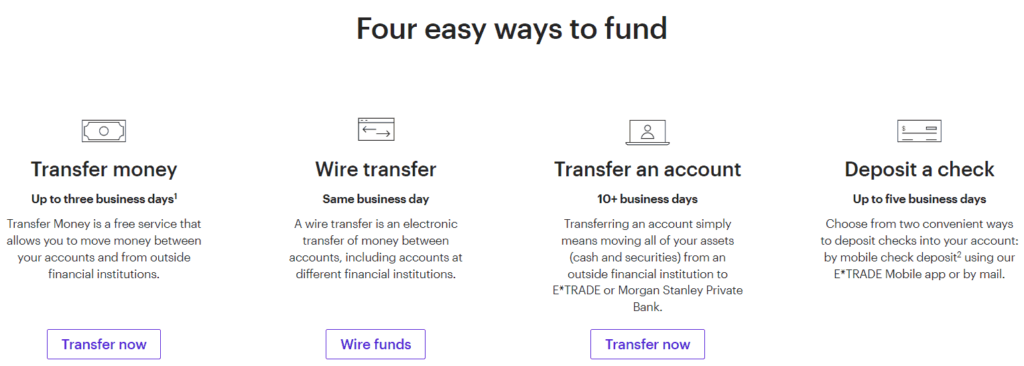

The broker provides many ways for users to put money into their accounts, making it easy for them to do so. Some of these ways are automatic clearinghouse (ACH) transfers, wire transfers, mobile check payments, and account transfers from other banks.

By offering a variety of funding choices, E-Trade caters to different tastes and makes it easy for users to pay for their trading and investing activities on the site.

With an average score of 8 out of 10, we gave E-Trade Funding Methods a good grade. There aren’t many fees, and there are several ways to get money.

Here are some good and bad things about the ways that E-Trade funds accounts were found:

| Advantage | Disadvantage |

|---|---|

| Fast digital deposits | No credit or debit cards for funding |

| Variety of funding methods |

E-Trade Minimum Deposit

The broker does not have a strict minimum deposit requirement for opening a brokerage account. However, traders should be aware that certain account types and trading activities may have specific funding or balance requirements.

E-Trade minimum deposit vs other brokers

E-Trade | Most Other Brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawals from E-Trade

Based on our research, the broker gives users a choice of different ways to get money out of their accounts. Investors can usually get their money back through an electronic funds transfer (ACH), a bank transfer, or by asking for a check. This gives them a number of choices to suit their own tastes and needs.

Take money out of E-Trade

The company gives you a standard list of steps you can take to start taking money out of your trading account.

- Sign in to your account.

- In the menu tab, choose “Withdraw Funds.”

- Type in the amount to be taken and pick the method of payment.

- Fill out the internet request with the needed information.

- Verify the payout information and click “Submit.”

- Through your Dashboard, you can see how the removal is going right now.

Platforms for trading

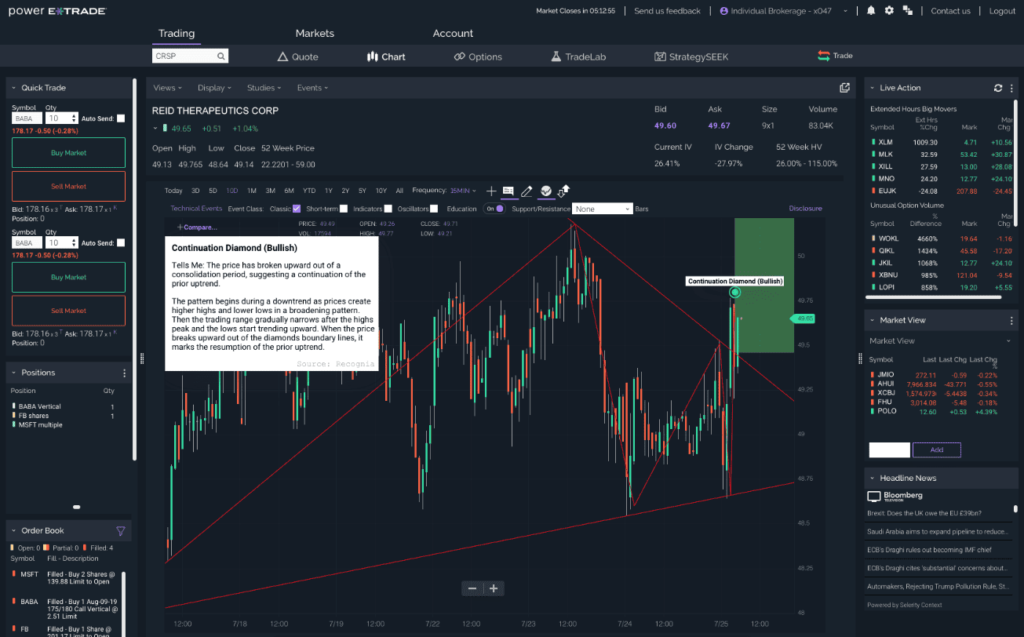

E-Trade offers a wide range of trade tools to meet the wants and desires of all investors. Power ETRADE Web has advanced features like real-time market information and easy-to-use tracking tools that make investing online smooth. The Power ETRADE app brings these features to mobile devices, letting users control their accounts and make trades while they’re out and about.

Users of all skill levels can easily access and use the E*TRADE app and computer services, which have user-friendly interfaces. By giving buyers a choice of tools, the broker makes sure that they can use the financial markets in a way that suits them.

Compared to more than 500 other traders, E-Trade Platform has a good score of 8.5 out of 10. We rate it as good because the company has advanced trade tools.

| Platforms | E-Trade Platforms | TradeStation Platforms | Merrill Edge Platforms |

|---|---|---|---|

| MT4 | No | No | No |

| MT5 | No | No | No |

| cTrader | No | No | No |

| Own Platforms | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | Yes |

App for E-Trade

Our research shows that the E-Trade app is a mobile tool that lets users easily control their financial accounts and make deals from their phones or laptops. The app has a simple design and gives you access to real-time market data, easy travel, and safe account information.

The app is a useful tool for mobile trading because it lets investors stay in touch with the stock market, keep an eye on their positions, and trade when they have the chance.

Help for Customers

The broker has customer service available 24 hours a day, seven days a week, to help users with questions, technology problems, and account-related issues. Support channels usually include phone support, email help, and social media channels. This gives buyers a number of ways to get help and advice.

We gave E-Trade’s customer service an average score of 8 out of 10, which means it’s good. The people who answered our questions were quick and helpful, and they were also easy to reach during business hours.

Check out what we found and how we ranked customer service quality:

| Pros | Cons |

|---|---|

| Quick responses | No 24/7 customer support |

| Relevant answers | No live chat |

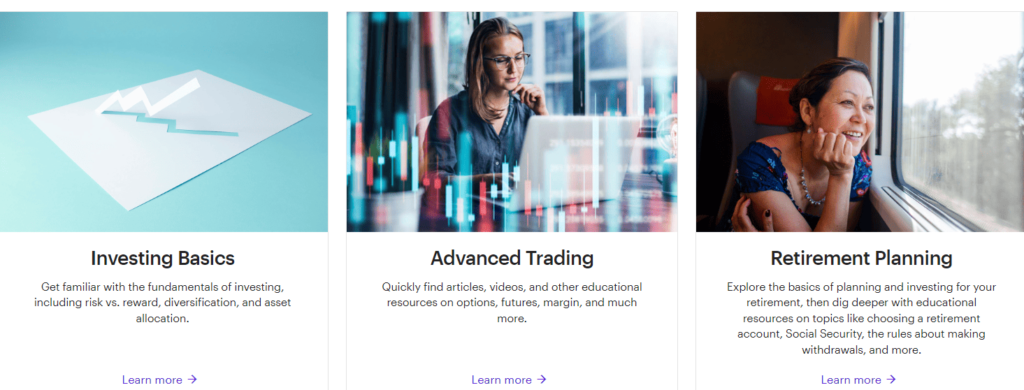

Learning about e-trade

In the end, the broker gives clients a lot of learning materials to help them understand the financial markets better. There are papers, videos, workshops, and engaging tools in these materials that are meant to help users learn more about trading tactics, market research, and business ideas.

Based on what we found, e-trade education got a total score of 8.5 out of 10. We learned that the company offers good study and training tools that can help traders who want to learn more about trading methods.

The End of the Trade Review

Finally, E-Trade is a trustworthy online exchange site that provides an easy-to-use environment, fair dealing conditions, and a wide variety of trading goods. In addition, the firm offers a wide range of training materials that give users the information and tools they need to make smart financial choices.

Overall, we thought that E-Trade had a lot of useful tools and features for buyers who want to get involved in the stock market. However, we suggest that you do your own study and see if the broker’s services meet your unique trade needs.

Based on what we found and what financial experts say, E-Trade is good for:

- Traders from the US

- Investing

- Stocks and Options trading

- Advanced traders

- Professional trading

- Commission-based trading

- Paper trading

- Competitive investment environment

- Good educational materials and research