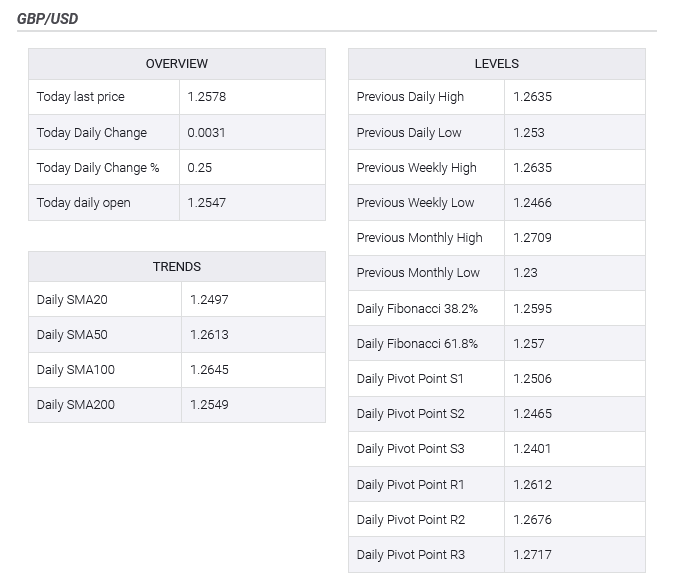

- GBP/USD trades above 200-DMA at 1.2547, lifted by positive sentiment.

- Technicals suggest upward trend, with resistance at 50-DMA (1.2609) and 100-DMA (1.2634/42).

- Fall below 200-DMA could favor sellers, next supports at 1.2500 and May 1 low of 1.2466.

During the North American trading session, the British Pound made slight gains against the US Dollar. With the Bank of England’s upcoming monetary policy decision in a week and positive market sentiment, the GBP/USD pair is trading higher at approximately 1.2579, staying above a crucial support level.

GBP/USD Price Analysis: Technical Perspective

The GBP/USD pair shows a neutral to slightly bullish outlook in the short term, having surpassed the 200-day moving average (DMA) at 1.2547. The Relative Strength Index (RSI) has moved into bullish territory, suggesting potential for the pair to approach the 1.2600 level, just shy of the 50-DMA at 1.2609.

Breaking above the 50-DMA could lead to the pair testing the combined resistance at the May 3 high and the 100-DMA, around 1.2634/42. A further push could aim for the 1.2700 level.

Conversely, if the GBP/USD pair falls below the 200-DMA, it might signal a shift in control back to sellers. The initial support could be found at the 1.2500 mark, followed by the May 1 low at 1.2466. Breaking these levels might lead the pair toward 1.2400 and then the April 22 low at 1.2299.