In this technical article, we are going to present Elliott Wave trading setup of Google Stock (GOOGL) . The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the setup and present the target levels.

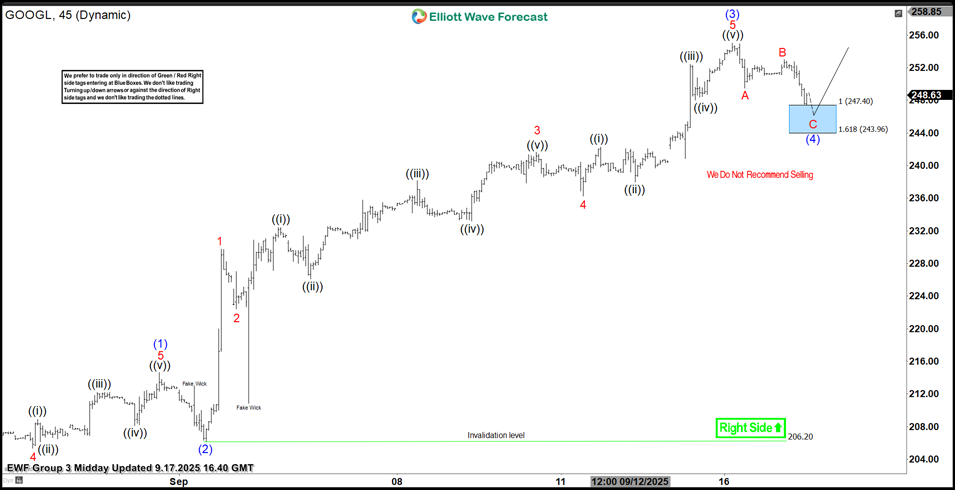

Google Elliott Wave one-hour chart 09.17.2025

The current analysis suggests that GOOGL stock is forming a wave (4) pull back. Blue Box comes at 247.4-243.96. That is our buying zone. We recommend members avoid selling Google stock, as the main trend remains bullish. We anticipate at least a 3-wave bounce from this Blue Box area. Once the price touches the 50% fib level against the B red connector, we’ll make positions risk-free, set the stop-loss at breakeven, and book partial profits. Stop Loss is placed a few points below 1.618 fib extension : 243.96.

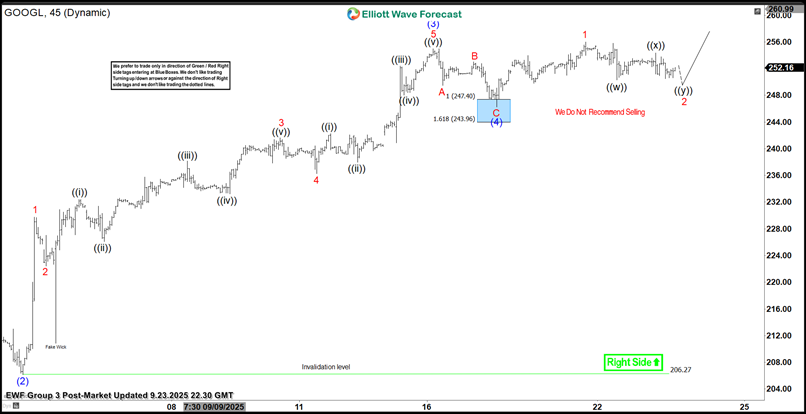

Google Elliott Wave one-hour chart 09.23.2025

The stock found buyers into the Blue Box area, just as expected. GOOGL completed wave (4) correction at the 246.39 low and made a decent reaction higher from our buying zone. As a result all long positions are risk free + partial profits have been taken. As long as price holds above the 246.39 low , further upside remains likely, targeting 257.0-260.3 area next.