Banco de Mexico (Banxico) reduced its main reference rates by 25 basis points as expected, to 7.50% with not a unanimous decision, with a 4 to 1 vote split, with Deputy Governor Jonathan Heath, voting for holding rates unchanged.

Voting in favor of the decision were Governor Victoria Rodriguez, Deputy Governors Galia Borja, Gabriel Cuadra and Omar Mejia.

Banxico is expected to continue its easing cycle as mentioned in its monetary policy statement. The decision was based on the current inflationary outlook, taking into account “the behavior of the exchange rate, the weakness of economic activity, and the possible impact of changes in trade policies worldwide. It also considered the level of monetary restriction that has been implemented.”

Officials noted that Mexico’s headline inflation increased “slightly, from 3.51 to 3.74%,” within the bank’s 3% plus or minus 1% target. The board mentioned that “Headline inflation expectations for the end of 2025 were revised downwards, while those for longer terms continued relatively stable at levels above target.”

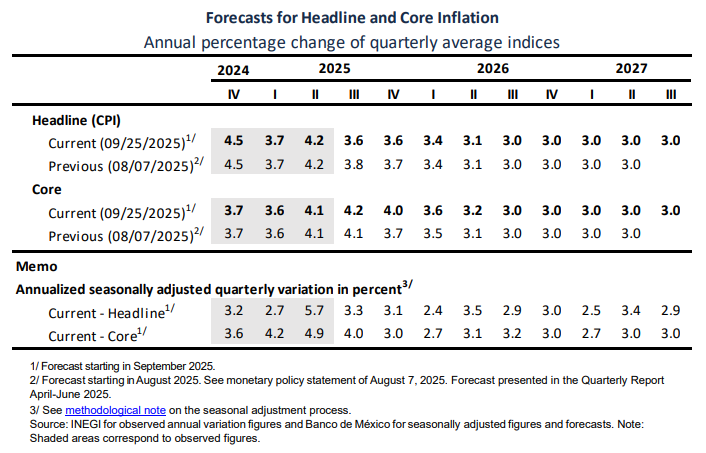

The board adjusted its inflation forecasts “slightly while core inflation forecasts were revised marginally upwards. Headline inflation is still expected to converge to the target in the third quarter of 2026.”

Banxico’s inflation forecasts

Banxico FAQs

What is the Bank of Mexico?

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

How does the Bank of Mexico’s monetary policy influence the Mexican Peso?

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

How often does the Bank of Mexico meet during the year?

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.