Yields fall in Europe and US after ECB policymaker says further rises ‘rather unlikely’

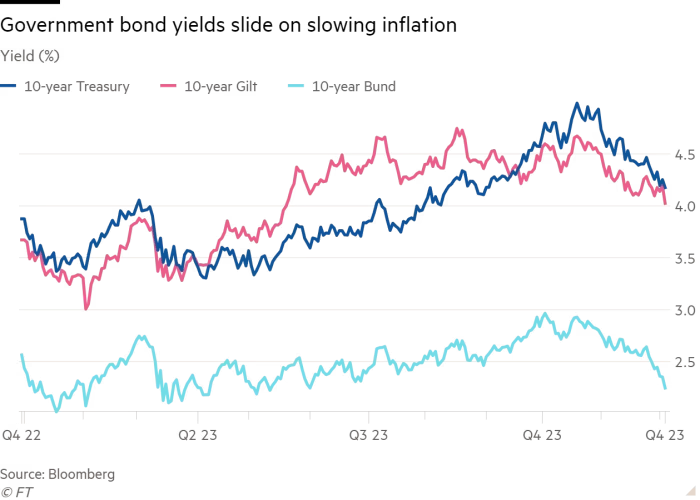

Government bond yields tumbled on both sides of the Atlantic on Tuesday as investors upped their bets that big central banks had finished raising interest rates. The rally for bonds — whose prices move inversely to yields — began after European Central Bank policymaker Isabel Schnabel said the region’s “remarkable” inflation slowdown has made further rate rises “rather unlikely”. The dovish comments sent benchmark German Bund yields down 0.1 percentage points to 2.24 per cent, the lowest level since early June, and yields on 10-year Italian debt 0.11 percentage points lower to 4.00 per cent. Yields on 10-year UK gilts dropped 0.17 percentage points — their largest daily decline since mid-March — to 4.02 per cent, their lowest level since May. Treasury yields fell in sympathy but consolidated their declines after US job openings fell to their lowest level since March 2021, boosting hopes that the Federal Reserve was winning its fight against inflation.

“Expectations for interest rates have fallen rapidly — unleashed by the Fed itself when chair Jay Powell said the bond market was doing its job for it, and then undoubtedly corroborated by the weakening data and the fact a number of ECB officials have jumped on that bandwagon, most recently Schnabel,” said Quentin Fitzsimmons a senior portfolio manager at T Rowe Price. Swaps markets are now almost fully pricing in the first 0.25 percentage point rate cut for the ECB by March next year and close to 6 quarter-point rate cuts by the end of next year. “The ECB cutting before the Fed is not the traditional pattern but maybe it reflects just how much the ECB has raised rates compared with its 25-year history,” Fitzsimmons said. Traders have ramped up bets on Fed rate cuts, pricing a 70 per cent probability of its first move in March, with five cuts priced by the end of 2024. The growing wagers on faster rate cuts come even as officials continue to insist they are not yet ready to start talking about lowering rates. “Investors are incredibly disoriented, along with policymakers, and that’s what [causes] these spectacular jumps on a day-to-day basis,” said Robert Tipp, head of global bonds at PGIM Fixed Income. US equities were less affected than bonds, with Wall Street’s benchmark S&P 500 down 0.1 per cent and the tech-dominated Nasdaq Composite up 0.2 per cent by midday in New York. Both indices enjoyed a bumper November, rising 8.9 per cent and 10.7 per cent, respectively. Germany’s Dax index meanwhile closed at an all-time high, as slowing inflation and the prospect of lower interest rates next year boosted the country’s biggest stocks. The index gained 0.8 per cent, moving above a previous high hit in late July, having climbed 8.6 per cent over the past month. Elsewhere, the region-wide Stoxx Europe 600 added 0.4 per cent and London’s FTSE 100 lost 0.3 per cent. Hong Kong’s Hang Seng index fell 1.9 per cent, as did China’s CSI 300.