Stock markets have bounced back from key buy levels, showing signs of recovery in the longer-term bullish trend.

In the Emini S&P March futures, the bulls continue to dominate, with a strategy of buying the dips proving successful despite a late sell-off on Friday. Yesterday’s buy signal at 5155 targeted 5175, with a potential retest of 5190/95 anticipated for today. A break above 5195 could lead to further gains towards 5210, possibly extending to 5224/26. Minor support is seen at 5145/35, with stop-loss orders recommended below 5125. Additional support lies at 5090/80.

Similarly, Emini Nasdaq futures bounced from the buy level of 18000/17900, hitting targets at 18100, 18160, and 18230. Further upside is expected, with targets set at 18260 and 18350/370. A break above the all-time high of 18436 would signal a bullish continuation. Strong support is anticipated at 18000/17900, with a stop-loss below 17800. However, a break below 17800 could shift the outlook negatively, leading to potential targets at 17600 and 17400 for short positions.

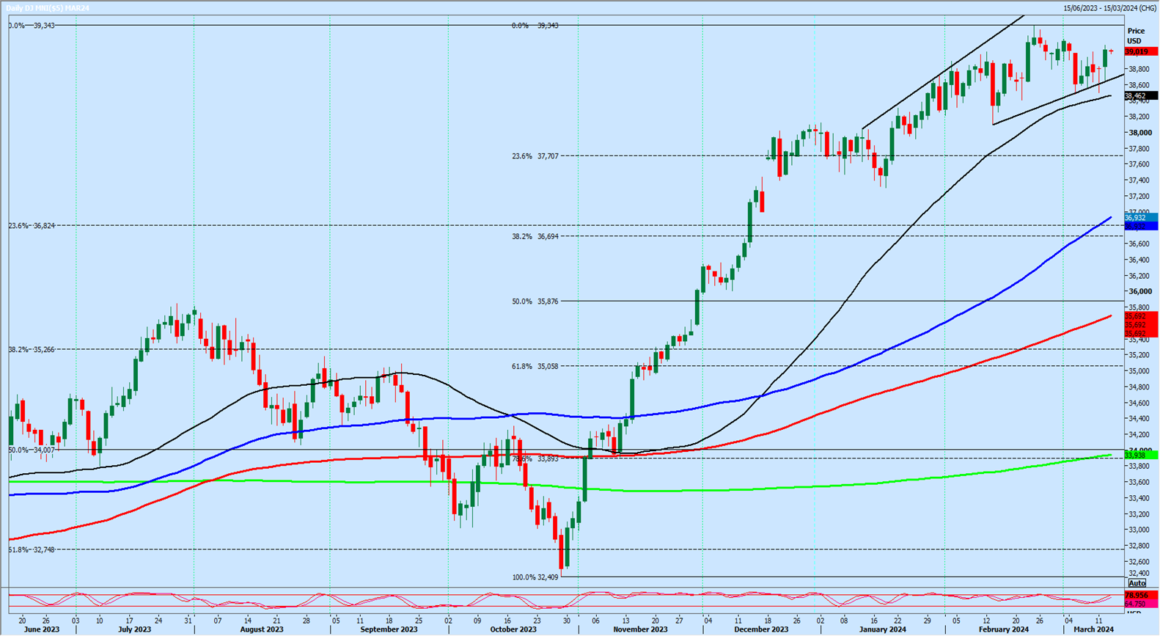

In the Emini Dow Jones March futures, a high for the day was reached at the resistance level of 38950/39000, following a bounce from support at 38550/500 on Monday. Long positions at this level yielded profits as the price reached 39000. Further upside targets include 39150 and a retest of the all-time high at 39290-39343. Support is observed at 38550/500, with stop-loss orders suggested below 38400. If the price breaks below 38200, downside targets are set at 38200/100.

Overall, the stock markets show resilience and potential for further gains, with buyers strategically positioning themselves at critical levels to capitalize on bullish momentum.