- The Japanese Yen edges lower as traders favor the US Dollar ahead of the Fed’s interest rate decision.

- The downside of the JPY may be limited as PPI jumped 2.4% YoY in May, exceeding market expectations of a 2.0% rise.

- The US Dollar maintains its position as robust US jobs data for May has diminished the likelihood of a Fed rate cut in September.

The Japanese Yen (JPY) has been on a losing streak for the fourth day in a row on Wednesday, with the USD/JPY pair strengthening as investors favor the US Dollar (USD) ahead of the Federal Reserve’s (Fed) decision and the release of US inflation figures for May later in the day.

Despite this, the Japanese Yen might find some support from higher-than-expected Japanese Producer Price Index (PPI) data, which showed a 2.4% year-on-year jump in May, surpassing market expectations of a 2.0% rise. This has raised concerns about potential consumer inflation.

The Bank of Japan (BoJ) is expected to keep its monetary policy unchanged on Friday. The ongoing interest rate gap between the US and Japan continues to weigh on the Japanese Yen (JPY), favoring the USD/JPY pair.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, remains strong following robust US jobs data for May, reducing the likelihood of a Fed rate cut in September.

Market Highlights:

- Japan’s Finance Minister Shunichi Suzuki emphasized the importance of maintaining economic growth and fiscal health to uphold confidence in the country’s fiscal policy.

- A Reuters poll suggests that nearly two-thirds of economists anticipate the Bank of Japan to begin tapering its monthly bond purchases at Friday’s policy meeting, signaling an initial step towards reducing the central bank’s balance sheet.

- Takeshi Minami, Chief Economist at Norinchukin Research Institute, stated that large-scale government bond purchases may no longer be necessary as a 2% price increase seems achievable.

- Japan’s 10-year government bond yield dropped below 1% ahead of the Bank of Japan’s policy meeting, with traders monitoring any potential changes in the bank’s monthly bond purchases.

- Japan’s Gross Domestic Product (GDP) for the first quarter contracted by 1.8%, slightly better than market forecasts, while GDP (QoQ) shrank by 0.5%, in line with previous data.

- Rabobank suggested that the Federal Reserve might cut rates in September and December due to a weakening economy rather than progress on inflation, foreseeing a stagflationary phase in the US.

- Bank of Japan (BoJ) Governor Kazuo Ueda stated that inflation expectations are gradually rising but have yet to reach the 2% target, indicating a cautious approach towards monetary stimulus exit.

Technical Analysis:

USD/JPY is trading around 157.20 on Wednesday, showing a bullish inclination as it consolidates within an ascending channel pattern on the daily chart. The 14-day Relative Strength Index (RSI) suggests upward momentum, with a significant hurdle at the psychological level of 158.00.

Further resistance levels are observed at 158.80 and 160.32, while downside support is seen around the 50-day Exponential Moving Average (EMA) at 155.03 and 152.80.

Japanese Yen price today

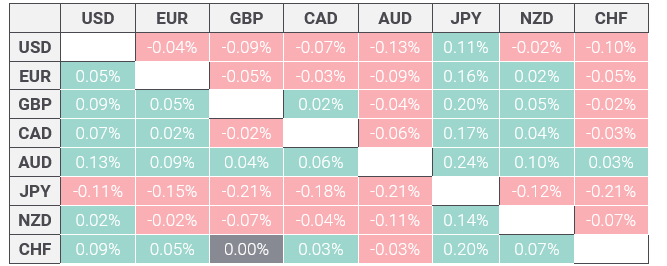

The table below shows the percentage change of the Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Australian Dollar.

The heat map displays the percentage changes of major currencies relative to each other. The base currency is selected from the left column, while the quote currency is chosen from the top row. For instance, if you select the Euro from the left column and follow the horizontal line to the Japanese Yen, the percentage change shown in the box will represent the movement of EUR/JPY.