- USD/CAD rebounds from a two-week low and draws support from a combination of factors.

- Weaker Oil prices undermine the Loonie and act as a tailwind amid renewed USD buying.

- Traders look forward to important US macro releases before placing fresh directional bets.

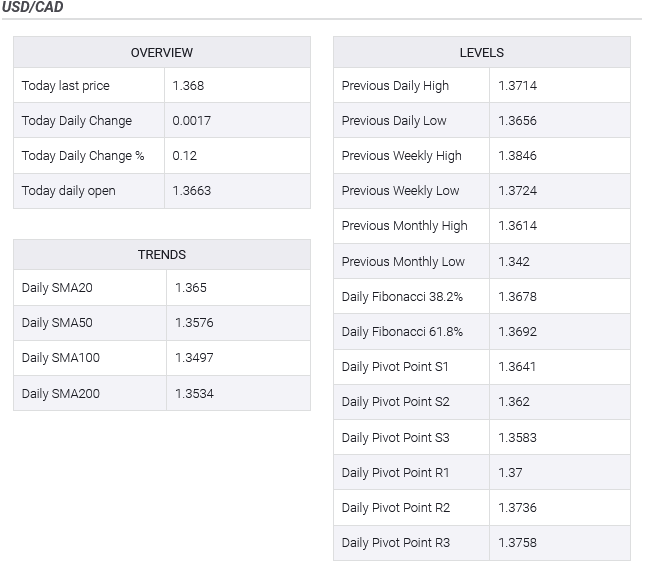

The USD/CAD currency pair has shown signs of recovery from its recent low around the mid-1.3600s, a level last seen two weeks ago. This improvement comes after a consecutive five-day decline. During the first half of the European trading session today, the pair has maintained slight gains and is currently positioned around the 1.3675-1.3680 area, marking the higher end of its daily trading range.

Concurrently, crude oil prices have had difficulty maintaining momentum following a notable recovery from support at the 50-day Simple Moving Average (SMA). This struggle is primarily due to reduced geopolitical tensions and worries over China’s slowing economic growth. These factors, coupled with the anticipation of an interest rate cut by the Bank of Canada (BoC) during the summer due to falling inflation and a slowdown in economic activity, are dampening the Canadian Dollar, which is closely linked to commodity prices. Meanwhile, this situation benefits the USD/CAD pair as the U.S. Dollar sees some buying interest at lower levels.

Investment sentiment is currently shaped by the belief that the U.S. Federal Reserve (Fed) will likely hold off on reducing interest rates until September. Additionally, expectations for rate reductions in 2024 have been adjusted to only two, given the persistent nature of inflation. This cautious stance supports higher yields on U.S. Treasury bonds, which in turn, bolsters demand for the U.S. Dollar. However, the overall positive risk atmosphere could deter investors from making aggressive bets on the U.S. Dollar, known for its safe-haven appeal, thus potentially limiting gains in the USD/CAD pair.

Investors may also choose to remain cautious and avoid significant positions ahead of upcoming key U.S. economic data releases. This includes the report on Durable Goods Orders later today, followed by the Advanced U.S. Q1 GDP figures and the Personal Consumption Expenditures (PCE) Price Index due on Thursday and Friday, respectively. These reports are expected to provide insights into the Federal Reserve’s potential rate cut trajectory, influencing short-term price movements of the U.S. Dollar and setting the direction for future movements in the USD/CAD pair.